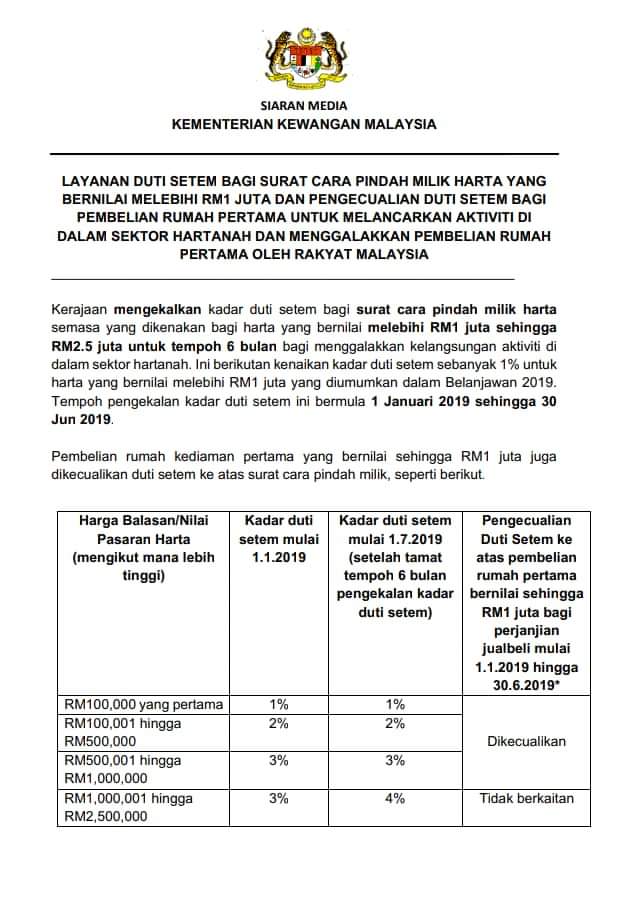

Section 82C provides for an exemption from stamp duty in respect of certain transfers of property involving pension schemes and charities where following the transfer the property continues to be held for the benefit of the pension scheme or charity. The stamp duty rate for transfer of property valued in excess of RM1000000 until RM2500000 effectively remains at 3 for the instrument of transfer of property that is stamped from 1 January 2019 to 30 June 2019.

Home Ownership Campaign Hoc 2019 Stamp Duty Exemption On Instrument Of Transfer Mot And Loan Agreement T C Applied Jtpropertyinfo Malaysia Real Estate Property S Blog Talk Review Resources Consultancy

Theres no Stamp Duty to pay.

. The market value of the property exceeds RM100000000 but is not more than RM250000000. The Stamp Duty Exemption No. Stamp duty exemption on any instrument in respect of the issuance guarantee and services in relation to the issuance of the Bonds which is executed between 26 February 2019 and 31 December 2019 pursuant to the Stamp Duty Exemption Order 2019.

Citation and commencement 1. You do not need to send the documents to HMRC. The threshold for non-residential land and properties is 150000.

The transfer document does not need to be stamped. 0 on the first 125000 0 2 on the next 125000 2500 5 on the final 45000 2250 total SDLT. Exemptions Some acts are exempt from Stamp Duty namely as mentioned below.

The requirement is as follow. Stamp Act 1949 Act 378 the Minister makes the following order. Stamp duty corporate reconstruction exemption changes 2019.

Rather concessional duty of 10 of the duty otherwise payable applies ie. Perlindungan Tenang Products. Income tax exemption on interest income and technical services fee.

Stamp Duty Exemption - Instruments of Transfer relating to Indirect Allotment or Redemption of 1 Units under Unit Trust Schemes and 2 Shares under Open-ended Fund Companies U3SOGPN08A Stock Borrowing Relief - Electronic Registration of Stock Borrowing and Lending Agreement U3SOGPN09A. The law applicable is the Stamp Duty Exemption No. The section confirms the existing stamp duty treatment which applied in relation to.

2 The rate is increased by 10 when the prize is paid in kind. Provides for stamp duty exemption on any insurance policies. 4 Order 2019 PU.

An effective top rate of 055 for corporate reconstructions. Stamp Duty Exemption No. This Order exempts from stamp duty any instrument of transfer executed in relation to the purchase of one unit of residential property having a market value not exceeding RM30000000 by an individual subject.

Should you have any enquiries please contact Lembaga Hasil Dalam Negeri at its Hasil Care Line at 1-800-88-5436. A 369 and Stamp Duty Exemption No 4 Order 2019 PU. Since 2019 the Malaysian Government has introduced various stamp duty exemptions as an initiative to stimulate the housing sector.

The changes will have a significant impact on decisions about undertaking a restructure in either of these states. Property value not exceeding RM500000 based on the SPA purchase price. It applies to any instrument of transfer entered into between the transferor and transferee under a rent to own scheme.

5 Order 2018 was gazetted on 31 December 2018 to provide a stamp duty exemption on any insurance policies or takaful certificates for Perlindungan Tenang products issued by a licensed insurer or a licensed takaful operator from 1 January 2019 to 31 December 2020 with an annual premium or takaful contribution not. Both Orders came into operation on 1 Jan 2020. 1 Regarding taxable events which will occur until the 31 December 2019 the corresponding tax rates are increased in 50.

First time buyers paying between 300000 and 500000 will. 1 Subject to subparagraphs 2 3 and 4 stamp duty shall be exempted. Stamp Duty Exemption No6 Order 2018.

If a transfer of shares is exempt from Stamp Duty. Corporate reconstruction exemption Under the new rules full exemptions will no longer be available. If transactions for the same assets occur within 30 days there is only one lot of duty ie.

41 and the Stamp Duty and Stamp Duty Reserve Tax Exchange Traded Funds Exemption Regulations 2014 SI. Budgetary concerns have also prompted both states to introduce other. Victoria and Western Australia have recently made material changes to their respective stamp duty corporate reconstruction rules.

The exemption may depend on certain requirements. First-time buyers From 1 July 2021 youll get a discount relief that means youll pay less or no tax if both the following. The SDLT you owe will be calculated as follows.

A 394 dated 26 Dec 2019 and 31 Dec 2019 respectively. 2014911 to ensure the effective operation of that legislation after the withdrawal of the United Kingdom from the European Union. Stamp Duty - 100 exemption Land Conversion Charges - 100 exemption Additional Benefits - For Women SCs STs Persons with Disability Enterprises Enterprises in Backward and most Backward Areas.

1 This order may be cited as the Stamp Duty Exemption No. These Regulations amend Parts 3 and 4 of the Finance Act 1986 c. From 22 November 2017 first time buyers paying 300000 or less for a residential property will pay no Stamp Duty Land Tax SDLT.

Recently the following Orders were gazetted under the Stamp Act 1949 in relation to the Home Ownership Campaign 2021 HOC 2021 and are deemed to have come into operation on 1 June 2021. Please click here to view the Orders see pages 2 to 14. 2 This Order is deemed to have come into operation on 1 January 2019.

Newsletter 17 2018 Comparison Of Various Rpgt And Stamp Duty Exemption Page 001 Jpg

Official Gazette Notification On Stamp Duty Exemption In Respect Of Loan Under Home Ownership Campaign 2019 News Articles By Hhq Law Firm In Kl Malaysia

Most Important Stamp Duty Exemptions For Holding And Subsidiary Companies

The 2019 Stamp Duty Exemption Property Insight Malaysia Facebook

Exemption For Stamp Duty 2020 Malaysia Housing Loan

The 2019 Stamp Duty 大马房地产爆料站property Insight Malaysia Facebook

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Stamp Duty Exemption Malaysia 2019 Malaysia Housing Loan

Act Extends Ev Stamp Duty Exemption To Electric Motorcycles

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia The Edge Markets

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia The Edge Markets

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Latest Stamp Duty Charges 6 Other Costs To Consider Before Buying A House In 2019 Cbd Properties

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Stamp Duty Exemption Malaysia 2019 Malaysia Housing Loan

Latest Stamp Duty Charges 6 Other Costs To Consider Before Buying A House In 2019 Cbd Properties

Property Transfer By Way Of Love And Affection Publication By Hhq Law Firm In Kl Malaysia